Google Sheets Investment Calculator

Access Google Sheets with a free Google account for personal use or Google Workspace account for business use. Thats where Causal comes in.

Financial Calculations With The Future Value Fv Spreadsheet Function The Wall Street Physician

It can be difficult to calculate Return on Investment directly inside of Google Sheets.

Google sheets investment calculator. Sometimes Google Finance will give errors for for certain investment symbols or dates. AirBnB Investment Calculator Example AirBnB Property Purchase Price129500 Mortgage Interest Rate5 Down Payment 2025900 Closing Costs 56475 Renovation Budget30000 Furniture Budget10000 Total Cash up Front72375 Gross Rentmo3000 less mortgage payment-556 less prop in. However if you want to just type in numbers like an online calculator feel free to use the spreadsheet Ive made above to run your numbers.

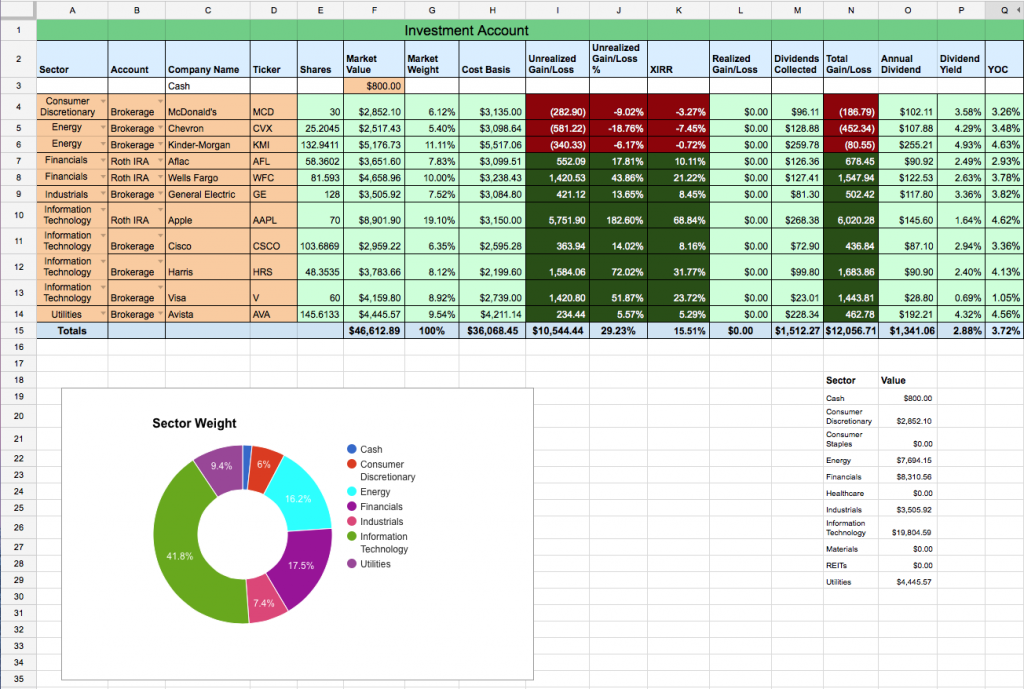

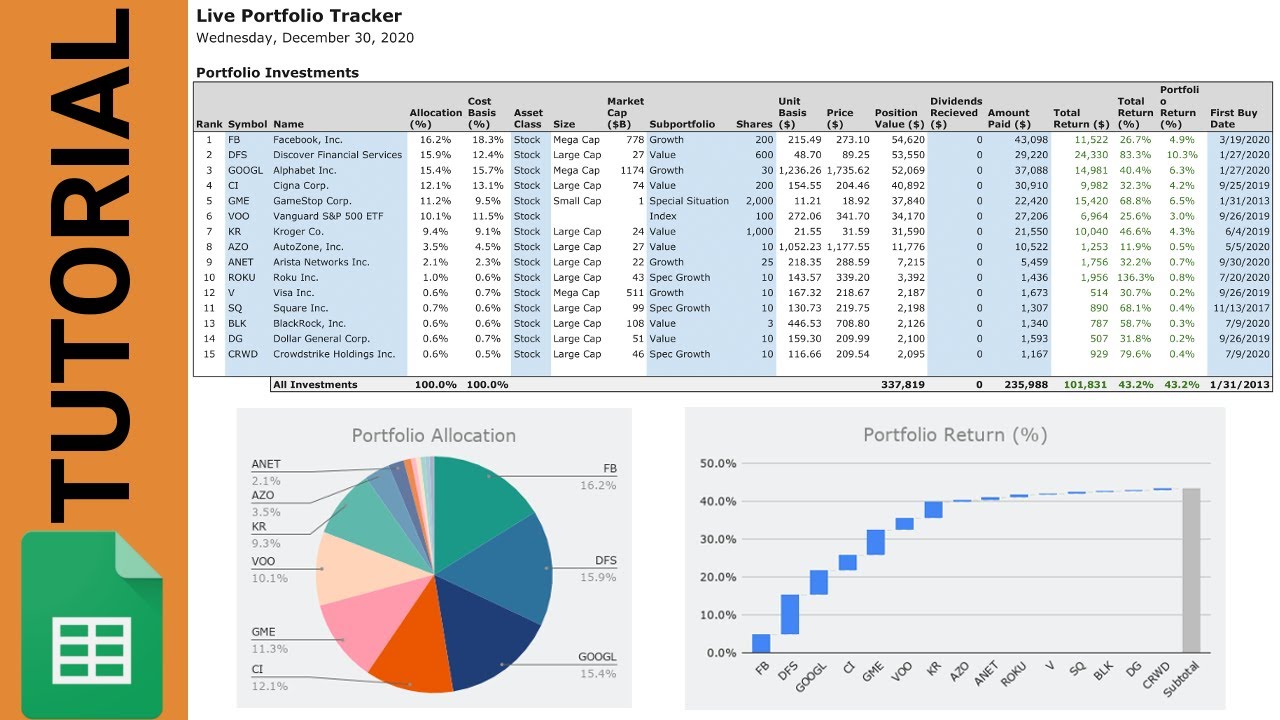

Stock Portfolio Tracker is Investment Moats attempt at creating an online spread sheet that will let a stock investor 1 Monitor your stocks in a portfolio 2 Track stock purchase by transactions 3 Transactions compatible includes purchase sale dividend and stock. Dividend Reinvestment and Growth Calculator. You simply connect Causal to your Google Sheets account and then you can build formulae in Causal to calculate your Return on Investment.

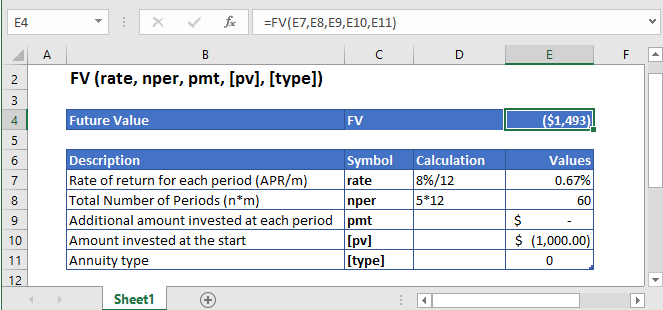

Edited for US Mkt By. Please enter a value between 0 and 1000000. The FV formula in Google Sheets is built just for this purpose.

The spreadsheet calculates how much you have in each asset class based on column D of the first page of the workbook. The future value function is a way to quickly do compound interest calculations using a basic spreadsheet. Built-in formulas pivot tables and conditional formatting options save time and simplify common spreadsheet tasks.

Taking into account the periodic payment amount and the interest rate that doesnt change over time it. Google Sheets makes your data pop with colorful charts and graphs. Length of time in years that you plan to save.

Using data from Google Finance Google Sheets can quickly and automatically pull in historic and current securities data so you can view performance in almost real-time. The power of Google Finance. Investments are made with after-tax dollars.

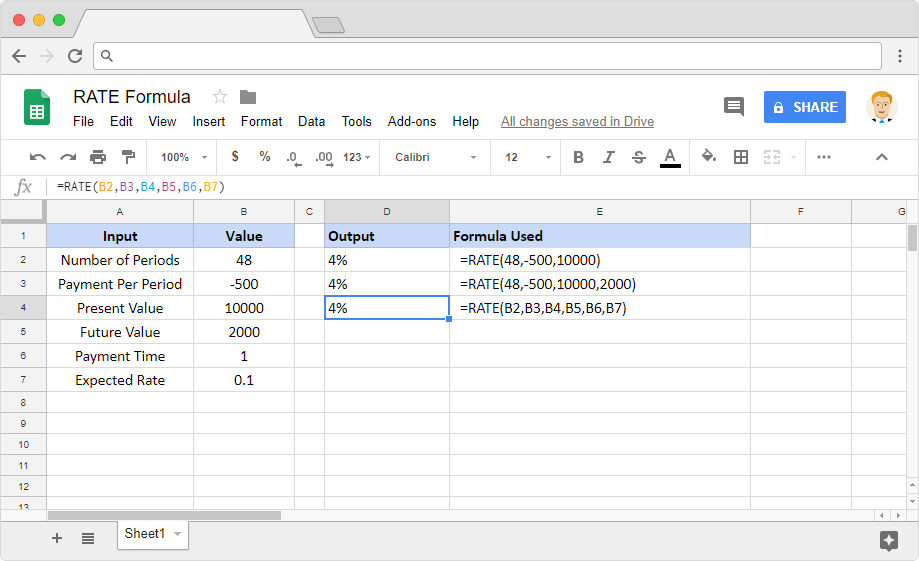

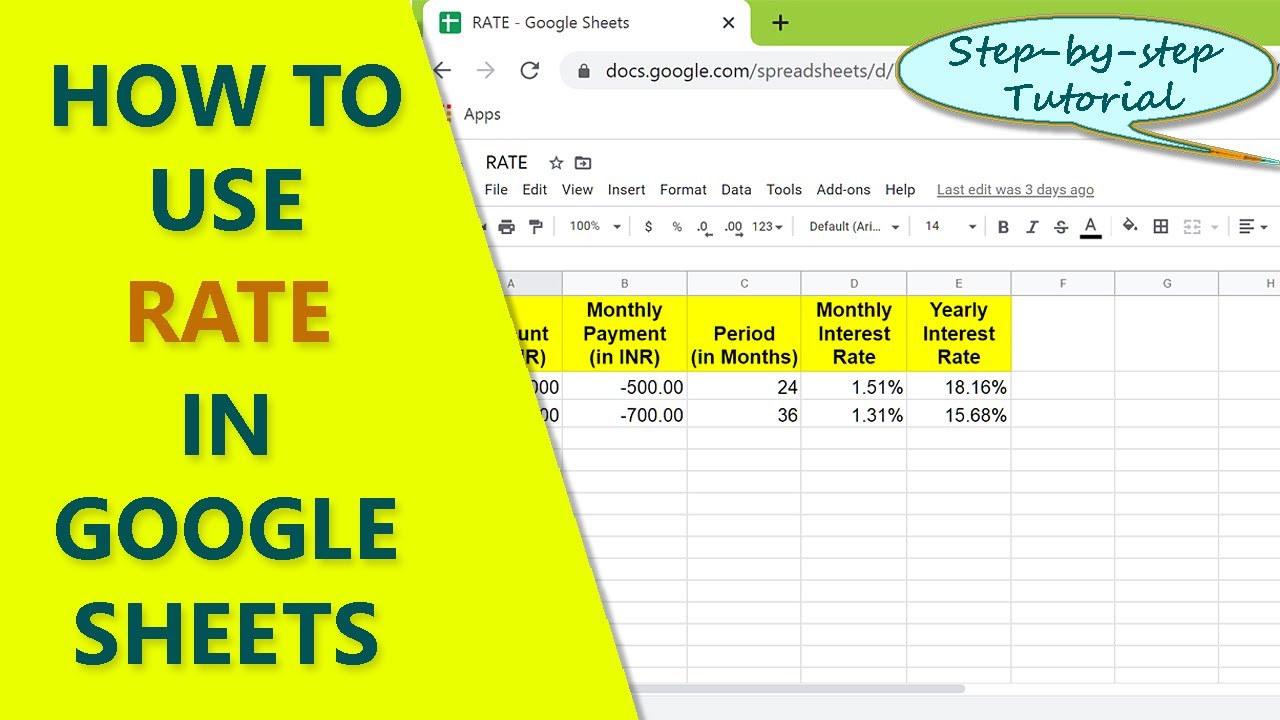

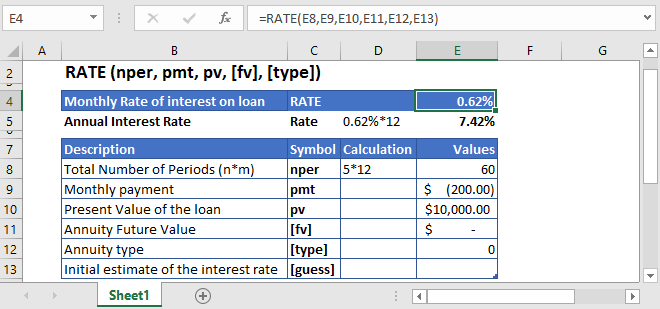

The Google Sheets RATE function returns the interest rate on a monthly or yearly basis for a loan or an investment. The model below allows input of several factors to produce the resulting values after each year in a 30-year period including an initial. This spreadsheet uses Google Finance to pull the prices of your investments.

This function needs three mandatory attri. Please enter a value between 1 and 60. The FV function in Google Sheets is all about finding the future value of a periodic investment at a fixed interest rate.

The Google Sheets NPV function returns the net present value of aninvestment for a discount rate and a series of cash inflows and outflows over a timeframe. Converted to be Google Spreadsheet compatible by Scott at. Its as easy a typing a single function in7 a spreadsheet like Microsoft Excel or Google Sheets.

A typical example of this is that you might want to find the todays value of an investment that will pay off in the future. Investment expected monthlyquarterlyannual investments expected rate of stock price appreciation initial dividend yield and expected. Quotes are not sourced from all markets and may be delayed up to 20 minutes.

If this still does not work you will need to manually enter the prices on the Your Portfolio Holdings tab. Apr 1 2021 Google Sheets is a great tool to perform financial calculations and analysis with. If you want to add or change asset classes you.

Google Finance data may be delayed by up to 20 minutes. But using a spreadsheet allows you to look at one document to get an overall picture of the health of your entire investment portfolio. The NPV formula in Google Sheets helps with just that.

The fact is that many of us are not well conversed in manual financial calculations. By using this function you can also find the future return of a lump-sum payment. Google Stock Portfolio Tracker.

Causal is a modelling tool which lets you build models on top of your Google Sheets data. If this is happening try refreshing the spreadsheet by refreshing your browser or by pressing F5 or controlF5. Information is provided as is and solely for informational purposes not for trading purposes or advice.

All for free.

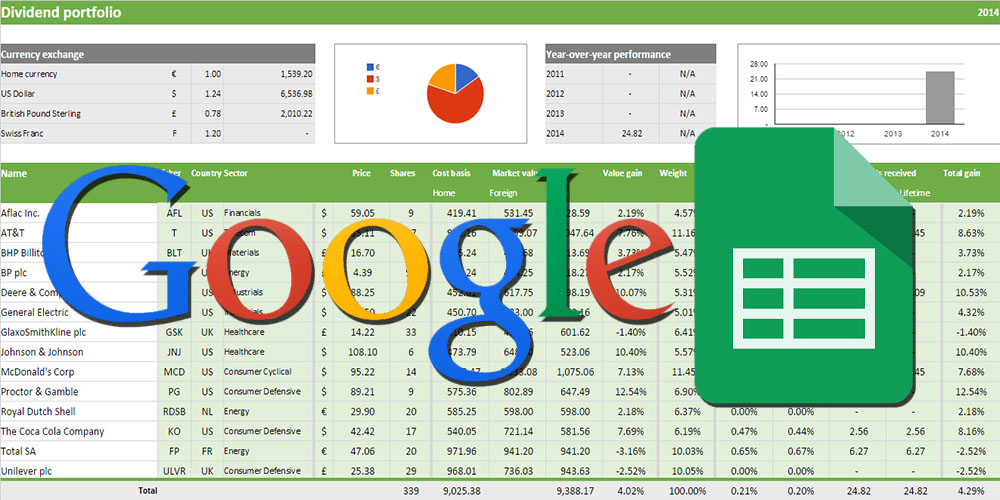

Using Google Spreadsheets To Track Your Dividend Portfolio Updated Template No More Waffles

Fv Function In Google Sheets Formula Examples

How To Use The Rate Formula In Google Sheets Sheetgo Blog

Google Sheets Rate Function Calculate Interest On Loan Or Investment Google Sheets Functions Youtube

How To Use The Npv Function In Google Sheets

Financial Calculations With The Future Value Fv Spreadsheet Function The Wall Street Physician

Dividend Stock Portfolio Spreadsheet On Google Sheets Two Investing

Top 5 Free Finance Templates In Google Sheets Sheetgo Blog

Rate Function Excel Calculate The Interest Rate

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

![]()

Top 5 Free Finance Templates In Google Sheets Sheetgo Blog

Google Sheets Formulas For Analyzing Marketing Data Analyticalmarketer Io

Stock Portfolio Tracking With Google Sheets Mybyways

Fv Function In Google Sheets Formula Examples

Fv Function Future Value In Excel Vba Google Sheets Automate Excel

How To Use The Irr Formula In Google Sheets Sheetgo Blog

Stock Portfolio Tracker Google Sheets Spreadsheet Tutorial Step By Step With Code Youtube

Post a Comment for "Google Sheets Investment Calculator"